Wage Garnishments: Manage Them Effectively, Efficiently and With Empathy

Estimated reading time: 5 minutes

(Editor’s Note: Today’s article is brought to you by our friends at ADP®, a comprehensive global provider of cloud-based human capital management (HCM) solutions. You can stay up to date on HCM topics with the ADP Spark blog. Check it out when you have a chance. And enjoy the read.)

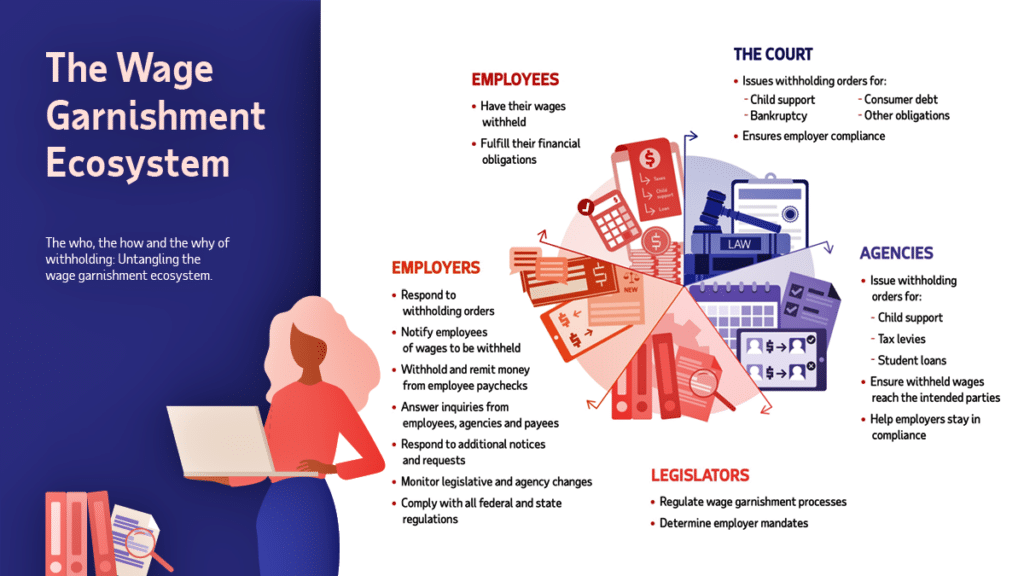

Last year, I published an article about wage garnishment compliance and risk avoidance. In the article, we highlighted three things.

- Wage garnishments happen more than we might think. In the ADP Research Institute white paper “The U.S. Wage Garnishment Landscape: Through the Lens of the Employer”, they report that 1 in 14 employees is subject to some form of wage garnishment. The most common type of garnishment is related to child support (50% +) with tax levies being second (19%). The report indicates that the highest number of garnishments are employees between the ages of 35 and 54. This group also has the highest wage garnishment rate. And approximately one in one hundred people have more than one garnishment.

- Different states have different laws pertaining to wage garnishments. For example, states might have different requirements regarding when garnishments are paid, how many garnishments an employee can have at one time, any deduction limits, and the fines to employers for not properly processing garnishments.

- Improper and insensitive handling of wage garnishments – even unintentionally – may create a lot of employee dissatisfaction. That’s what I want to talk about today – handling wage garnishments effectively, efficiently, and respecting employees along the way.

Putting the “Human” Back into HR

There’s this little phrase that I sometimes hear in HR about putting the “human” back in human resources. Regardless of your feelings about the phrase, my take is that the intent is for HR departments to be empathetic (aka be more “human”). HR should remember what it’s like to be a candidate to develop a positive candidate experience. HR should remember what it’s like to be a new hire to design a welcoming and effective onboarding experience.

And even if we’ve never personally had a garnishment, we should remember what it’s like to be an employee who is looking for answers, privacy, and discretion in managing the wage garnishment process. The way we can do that (meaning bring more empathy into HR) is by allocating our resources effectively and efficiently. Which in turn, will allow us to spend a little more time focusing on empathy. We can specifically use this idea when it comes to managing wage garnishments.

HR departments should spend their time on things that only they can do. This is how they become effective and efficient. We often talk about this when we think of technology. Let the technology do what it does best, and HR will focus on what it does best.

This same philosophy applies to wage garnishments. Find a solution that does garnishments well so HR can spend their time focused on the employee experience.

ADP’s Wage Garnishment Solution

Our friends at ADP have a wage garnishment processing and disbursement solution that helps organizations reduce administration, improve compliance, and mitigate risk. The ADP wage garnishment solution ensures that:

- Organizations are following each state’s garnishment laws.

- Accrued funds are dispersed in a timely manner, including electronically when required.

- ADP experts are available to offer assistance for complex garnishment orders or when an employee has more than one garnishment.

- Reports are available for organizations to monitor and audit the status of garnishments.

I know some of you might be saying, “This sounds wonderful! But we don’t use ADP payroll.” No worries. Their wage garnishment solution is a stand alone feature and integrates with the top ERPs (enterprise resource planning software). So, you don’t have to be an ADP client to take advantage of this solution.

This type of solution allows organizations to … as I mentioned earlier, put the “human” back in HR. Let’s face it, often when employees have a question about their paycheck, they go to HR first for answers. Can HR and payroll work together to manage wage garnishments? Of course. But it takes a lot of time. That’s time HR and payroll could be spending on other things.

The ADP Wage Garnishment solution allows HR and payroll to spend their time with the employee – answering questions, etc. That’s what the employee wants to know – how their garnishment works. And they want it handled with the sensitivity and respect it deserves. ADP can take care of the filings and help accomplish the organization’s goal of having an effective, efficient, and compliant process.

Organizations Should Manage Their Resources Well

I’ve mentioned before that as HR professionals, just because we can do something doesn’t mean we always should. I believe that organizations are hyper focused on being effective and efficient right now – which means that they’re looking at their current processes for opportunities to reallocate resources.

To help you manage wage garnishments, ADP has put together a checklist for employers. It’s a great representation of how complex garnishments can be and all the individual steps that need to be done. This is a good place to start looking at your wage garnishment process and evaluate where the organization wants to be hands-on and where a partner makes good business sense.

67